Fake Payslips Download

A payslip template is formal document which is given to employee along with his salary. It is very beneficial for employee as it helps him to make sure that he is on the right tax code, right amount has been deducted as tax, what amount has been earned by him in total. Choose desirable payslip template from our provided templates which are prepared in MS Word and Excel especially for you. You can download all of them or any one from them, based on your appropriate requirements and needs. This professional format is very beneficial for employee as it helps him to make sure that he is on the right tax code, right amount has been deducted as tax, what amount has been earned by him in total, what amount has been deducted as insurance and total earning of the employee. It is a slip that is given to employee along with his salary. A payslip template will also act as evidence that he has been paid. Employers should send payslip to the employees even when they are on leave. It is a small written document generate by company for explaining the facts about the pay of employees.

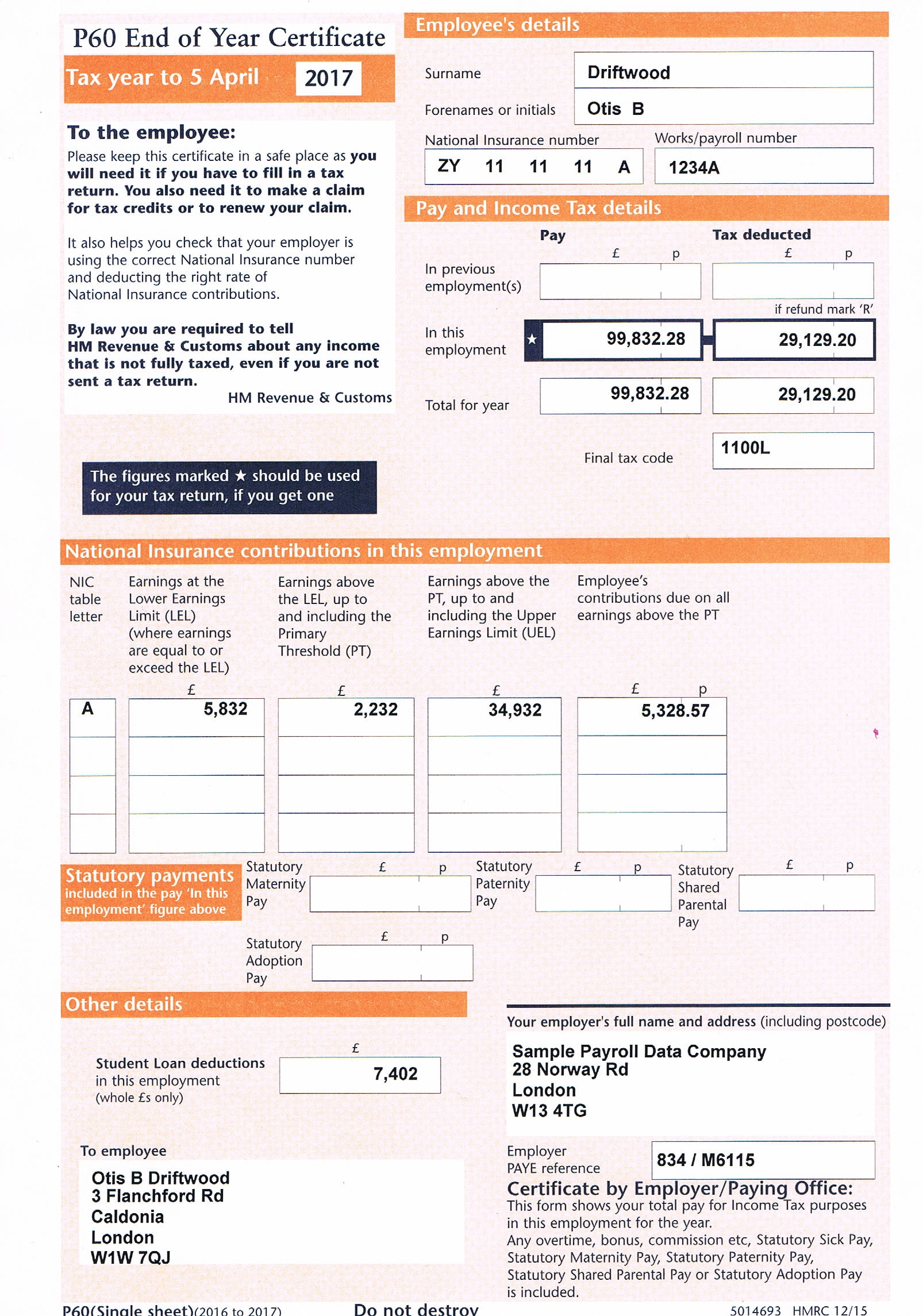

1 Payslips = £10; 2 Payslips = £15; 3 Payslips = £20; 6 Payslips = £35; 12 Payslips = £50; Other = please contact us for a quote. Please select the Payslips Picture below to start the process: Please see our samples page for a larger image. Providing incorrect or inaccurate information for the purpose of misleading others is. The payslips generated also consists of all tax deduction components such as Income tax, Professional tax, and EPF. Thus, you do not have to worry about remembering what details to fill in, you simply put the values in the template. The Asanify payslip generator allows for instant payslip download even on mobiles so you can get immediate access.

Share payslip PDFs to employees with a detailed breakdown of their earnings, taxes, deductions, and allowances. Lend credibility to salary statements Make your salary slips look professional by including crucial information like date of payment, pay period, and UAN number.

Importance of Payslip Template

This smart slip will include both description as well as numerical data about the salary of an employee. Generally this contains some basic information such as name of employee, his designation, name of employer, date of pay, month of pay and title of company. To all appearance, a format for pay slip should be drafted as a professional manner, because a pay slip is significantly beneficial for employee as it’ll helps him to keep it as evidence of pay. Apart of this, a pay slip template will makes sure that employer has granted the pay to specific employee on certain date. Thus, this slip will use to account the right tax code of employee; seemingly it’ll also assist the employee when he’s applying for an insurance policy. We tried our level best to provide you ready to use and turnkey template which you can utilize spontaneously once downloaded. The above provided template is special example of high quality as far as professional forms are concerned.

Quality of Payslip Template

We believe in quality and therefore, offering our free template for downloading which will certainly met your quality standards. However, you may contact us for changes or amendment you may feel necessary in any template provided in this website. This template is effectively significant while taking print out after completion. You do not need to define printing setting while taking print.

Payslip Template PDF

www.commerce.wa.gov.au

Payslip Sample

www.commerce.wa.gov.au

Online Payslip Template

www.rit.edu

Monthly Payslip Template

www.sensysindia.com

Employee Payslip Download

Payslip Example

toolsfortransformation.net

Payslip Layout

www.cronecorkill.co.uk

Working in an organization, you may have often come across a slip addressed directly to an employee indicating their salary and allowances for a particular month. This slip is known as a payslip. Payslips are issued every month and to every employee. A pay slip is a statement showing how much an employee earned in a gross amount less the deductions for Special funds such as Providence and pension funds. Payslips are commonly used in organizations big or small.

In older days, pay slips were printed and given to employees as hardcopy. This practice is still common in some organizations. Many organizations also choose to email the payslips to employees.

Large organizations usually have online portals for their employees to manage their profiles, file online applications, and manage other administrative duties. These organizations also use the employees’ portal to upload payslips. So, each employee can log in into the portal and access their payslip online. Uploading on the online portal saves considerable paper and expense.

There are several benefits of payslips. Payslips are a way of communication about the salary between the organization and its employees and it works to effectively minimize any misunderstandings. Payslips can also prove helpful during external and internal account audits. Payslips are useful in comparing discrepancies that may arise when calculating provident or pension funds.

Every organization, big or small, issues payslips to its’ employees. A payslip is a statement of income and deductions for a particular employee. Each payslip is unique to a particular employee with their name on it. The payslip for one employee cannot be given to another since it is addressed to the employee with his/her name and employee ID.

Payslip and payroll both refer to two separate concepts. A payslip shows the salary and deductions for a particular employee only. On the other hand, a payroll is the list of all the employees working in an organization. The payroll not only lists the employees but also their salaries, bonuses, and any taxes withheld. Thus, the payroll is the total amount of salaries paid by an organization, and a payslip is for an individual employee.

In terms of importance, a payslip is important for the employee, so they are aware of the breakdown of their salary. Similarly, the payroll is critical for the HR department in the organization since any discrepancy in the payroll may cost the organization a huge loss. It is the responsibility of the HR department to ensure that the payroll is accurate and timely.

Both payroll and pay slips are generated at regular intervals. These intervals can be weekly, bi-monthly, or monthly. The most common duration is monthly.

A payslip generally includes:

- name of the organization

- name of the employee

- employee ID

- gross salary for the month

- any allowances such as housing, travel or communication allowance

- bonuses if applicable

- deductions for providence fund, pension funds

- taxes withheld

- net salary

A payslip may also include the past few months’ histories of gross and net income. The net salary is the take-home salary that the employee can spend.

Download Payslip Format In Excel

A payslip is an internal, yet binding document issued by an organization. If someone wants to apply for a loan or credit card, they can use previous payslips as proof of salary. Moreover, by law, every organization must provide payslips to all its employees every time a payment is made to the employees. Thus, an organization that pays bi-monthly, must provide bi-monthly payslips. Thus, payslip is a legal document.

See the templates below.

Preview

MS Excel [.xls] | Download

Weekly Payslip template

Payslip Download Windows 10

MS Excel [.xls] | Download

Biweekly Payslip Template

MS Excel [.xls] | Download

Monthly Pay Slip Template

Free Payslips To Download

MS Word [.docx] | Download